First, timely processing is essential in reconciling

the physical counts and in-process transactions with

record balances. Delays in processing adversely affect

stock point operations.

Secondly, the DSCs have automatic control

features that will cancel the inventory after a specified

number of days. Inventory counts received after the

controls have been lifted will not proms. As a result,

the DSC records will not be reconciled or updated. If

this happens, the stock point has wasted its mourns.

The scheduled inventories requested by Navy

activities must be completed within 30 calendar days of

the actual cutoff date. Inventories requested by DSC

must be completed within the following time frames:

l For a complete inventory, the results must be

forwarded within 30 days of the actual cutoff date.

l For a sample inventory, the results must be

forwarded within 20 calendar days of the actual cutoff

date.

Unscheduled inventories requested by Navy or

DSC must be completed within 15 calendar days of the

actual cutoff date.

Physical Inventory Adjustments

When a discrepancy between the physical count

and stock record cannot be reconciled, an adjustment

must be processed. The adjustment will result to a gain

or loss on the stock record.

Reversal of Inventory Adjustment

The Military Standard Transaction Reporting and

Accounting Procedures (MILSTRAP), DOD Manual

4140.22-M, permits the reversal of inventory

adjustments. The inventory adjustment must be within

365 days from the date of the adjustment. Reversals of

inventory adjustments are permitted only if the

following conditions are met:

1. If the original adjustment can be identified,

inventory adjustment reversals will be permitted.

2. There has been no separately identifiable

physical inventory conducted between the date of the

original adjustment and the date the reversal is

attempted. If an inventory has been completed between

the date of the original adjustment and the date reversal

action is attempted, the reversal will not be permitted.

If an inventory has been initiated subsequent to original

adjustment, and causative research indicates the

original adjustment was erroneous, a reversal of the

original adjustment is permitted.

3. There are documentations to support the

conclusion that the adjustment is in error.

4. Reversals to adjustments greater than 90 days

old must be approved by the inventory accuracy officer

according to NAVSUPINST 4440.132.

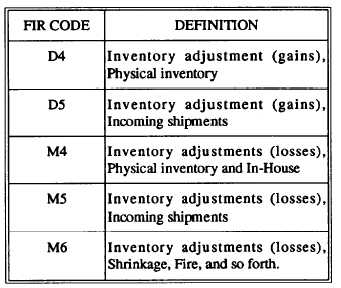

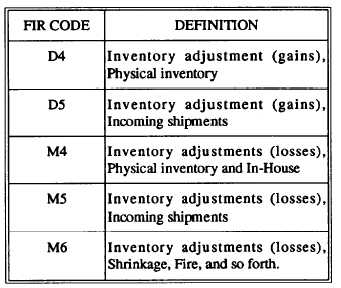

5. Adjustments must be reversed through credit

loss or gain procedures. Transactions should not be

reversed by complimentary financial transactions. For

example, an M4 loss should not be reversed by a D4

gain, but with a credit loss. Refer to Table 5-4 for

definitions of M4 and D4 financial inventory report

(FIR) codes.

Special Reporting Requirements

Results of inventory for controlled items require a

report to be submitted to the applicable item manager.

A Missing, Lost, Stolen, or Recovered (MLSR)

property report is required whenever there has been a

gain or loss of sensitive material. The MLSR report is

used only as an initial report. ADD Form 200, SF 364,

or SF 361 is required as the final documentation of the

gain or loss.

The DD Form 200 is the Financial

Liability Investigation of Property Loss. The Standard

Form (SF) 364 is the Report of Discrepancy. Standard

Form (SF) 361 is the Transportation Discrepancy

Report. Refer to SECNAVINST 5500.4 for detailed

information concerning the MLSR report.

Table 5-4.-Inventory Adjustment FIR Codes

5-11